Is it feasible to generate money in an unpredictable market?

The implied volatility options strategy contains the solution.

Because implied volatility (IV) may fluctuate fast and have a large influence on option premiums in either direction, it is one of the most essential metrics for traders. Implied volatility trading tactics may be simple or sophisticated, with a wide range of methodologies and often confusing vocabulary. Is anybody interested in the Vega-neutral options trading strategy?

Regardless of their sophistication, all volatility trading systems are based on two basic concepts: implied volatility and historical volatility.

We mention the five tried-and-true strategies for trading implied volatility below, along with some examples of how an investor may use them. These options trading tactics, although basic, may bring significant trading gains, but they also include a lot of risks.

Before we begin, here are some key facts concerning term structure and option volatility analysis.

Recognizing implied volatility in trading options

Implied volatility (IV) is the market’s prediction of future stock price variations for an underlying asset.

When determining the premium of an options contract, stock traders consider both the predicted level of price volatility and the direction of the underlying asset’s price movement. The term implied volatility refers to the predicted level of volatility.

Implied volatility looks ahead, while historical volatility takes into account recent price variations. We compute it using the current market price of the option, rather than making it easily visible. We can calculate the market’s indicated volatility backwards from the option premium using options pricing models like Black-Scholes.

Traders utilize implied volatility in a variety of ways. For starters, it helps clients determine if their selections are relatively cheap or expensive; options with a higher IV would normally have higher premiums. Second, some traders attempt to profit by buying when the IV is low and selling when it rises.

How Implied Volatility Operates Using an Illustration

We will use the stock of Apple Inc. (AAPL) as a real-world example. Suppose we are examining two different expiry dates, and the current market price of AAPL is $175:

An IV of 25.4% suggests a potential price movement of approximately $15.20 for the 30-day expiration period. This corresponds to a trading range of $159.80 to $190.20 throughout the next 30 days.

After 180 days, the IV spikes to 32.8%, suggesting a higher possible swing of almost $45.60. Over a six-month timeframe, this forecasts a widened range between $129.40 and $220.60.

Despite the fact that 87% of options traders fail using implied volatility approaches, you may be among the top 13%.

Here’s how.

How to Use Implied Volatility Options in Five Simple Steps.

Trading implied volatility (IV) allows options traders to profit on changes in the market’s expectations of future volatility. Some typical strategies for trading implied volatility are as follows:

- Long and short straddle

- Long and short strangle

- Iron condor options

- Long calendar spread options

- Vega-neutral strategies

The long strangle approach is, in our view, the best ohjptions trading strategy for surpassing market makers in their own volatility trading game.

The steps are as follows:

Developing a Successful Strategy for Implied Volatility Options

To trade implied volatility, employ the long strangle options strategy, which involves buying one long call and one long put. The options have the same underlying stock and expiration date, but their out-of-the-money (OTM) strike prices differ.

This suggests that the put strike will be lower, while the call strike will be higher than the current stock price. So, what makes this superior to other volatility trading strategies?

Tired of losing trades? Open a Libertex account to start trading stocks and forex with the professionals today.

Let’s take five basic steps to cover the fundamentals of a long strangle strategy:

Step 1: Determine the market situation.

When a trader anticipates a significant change in the underlying stock’s price, either upward or downward, and the stock chart’s price consolidation indicates low implied volatility, they often use a long strangle.

Starting a strangle options strategy may be more appealing in this scenario since the cost of purchasing call and put options may be lower.

Major stock market events like these often prompt the use of long strangles.

- Release of earnings,

- Merger declarations,

- Releases of new items

- Vote by shareholders, etc.

For example, imagine you predict Apple’s stock price will move 8-10% in either direction after the earnings release.

Step 2: How to Select the Best Choices with the Lowest Implied Volatility

When a stock trader uses the long strangle method, they are effectively constructing two different options positions: a call option above the current price and a put option below it.

When picking options with low implied volatility, consider the following factors:

- Date of Expiration: Choose a date that corresponds to the time period when you expect the price change.

- Strike Prices: When implied volatility is low, select call and put strike prices that have a larger gap between them and are approximately similar to the current stock price.

For example:

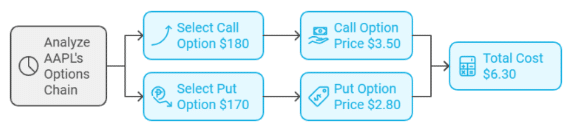

After reviewing the AAPL options chain, you decide to focus on the weekly options expiring on the Friday after the earnings release. You select a slightly out-of-the-money call option with a strike price of $180 and a marginally out-of-the-money put option with a strike price of $170.

Given that the call and put options are currently trading at $3.50 and $2.80, respectively, the long strangle position will cost $6.30 in total.

Step 3: Calculate Break-Even Points

The final phase in the implied volatility options approach is to calculate break-even points.

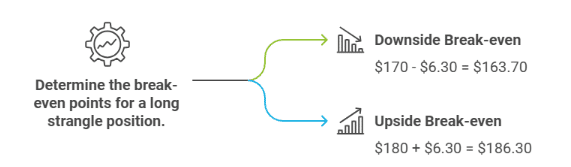

To calculate the break-even marks for a long strangle position, add the whole cost of the transaction (call premium + put premium) to the lower strike price for the downside break-even and subtract it from the higher strike price for the upside break-even.

Here’s an example of how to calculate implied volatility:

For example:

To get the break-even marks for this long strangle strategy, subtract the entire cost from the higher strike price of $180 for the upside break-even and add it to the lower strike price of $170 for the downside break-even.

On the downside, the break-even mark is $170 minus $6.30, or $163.70. The upside breakeven mark is $186.30, calculated as $180 + $6.30.

Step 4: Monitor Volatility and Price Movements

The fourth phase in the implied volatility options technique is to monitor price and volatility variations.

If the stock price changes significantly in either direction, you may need to alter your position or consider taking winnings. However, if the stock price begins to approach one of the break-even marks, you may need to alter your position or consider selling it.

Step 5: Execute and manage the transaction.

When conducting a long strangle trade, pay attention to the options’ bid-ask spreads and aim for the best execution price. A comprehensive exit strategy is also necessary, encompassing the following elements:

When the stock price crosses one of the break-even thresholds, the transaction is complete.

You may be able to get partial gains if the transaction hits a particular percentage of your target.

Changing the position via rolling the options or adjusting the option strategy

For example:

On the day of the results announcement, AAPL’s stock price rises 9% to $185 per share. Your $180 call option is now worth $5.00, while your $170 put option has expired worthless. When you sell the call option, you lock in a profit of $1.50 per contract ($5.00 – $3.50).

Five Key Takeaways from the Implied Volatility Options Strategy

Follow these five simple steps to understand how to use implied volatility options:

- Look for equities with moderate implied volatility and expected price movements of 8-10%.

- Consider investing a small amount in OTM call and put options.

- The downside break-even point is defined as the lower strike minus the total premium.

- Pay alert to any unusual motions.

- Maintain position sizes of 1% to 2% of the account to decrease risk.

You can also read: 3 Strategies for Volatility Trading: Earn Money without Predicting Price Direction

Thank you for taking the time to read. Follow for the latest news and information.Telegram Channel