Overview: Gold Trading Process

Using the same trading method as the smart money is the most effective way to trade gold or any other commodity. Our easy gold trading method is based on what has proven effective in the financial markets.

This implies that it is a strategy for determining when to commence trading and may be used to nearly any time range. Whether you’re considering longer time horizons for long-term investments or short-term transactions vs exits.

Investing in gold is a good strategy to secure your money if you are worried about inflation or the state of the economy in general. However, if you want to profit when we trade gold and capitalize on gold trends that need a method, then adopt our easy gold trading approach.

This course provides all of the knowledge you need to trade gold like the large institutional players. In addition, our training includes the greatest fractal trading approach.

Let’s start by learning the gold trade secrets!

Tired of losing trades? Open a Libertex account to start trading stocks and forex with the professionals today.

Techniques for Trading Gold

We will provide a variety of seasoned investors’ gold trading strategies.

There is a link between gold’s seasonal rhythm and transportation.

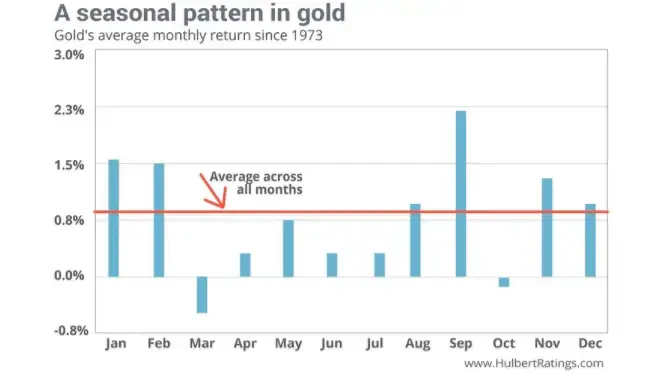

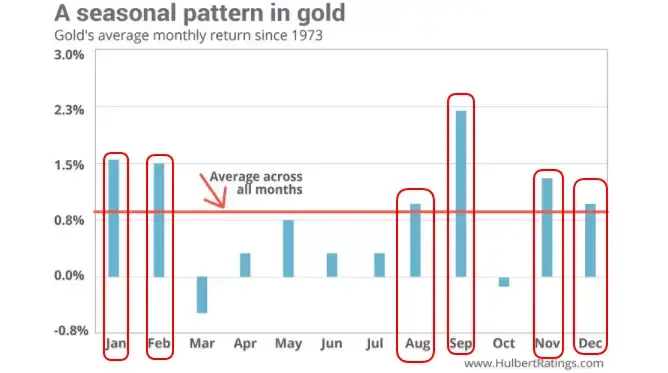

At certain seasons of the year, gold is most valuable. Furthermore, gold prices often fluctuate throughout the year. It would be fantastic to know ahead of time if gold is expected to climb or decline.

One of the most notable aspects of natural occurrences is that they repeat themselves at the same times of year. Generally, winter brings snow, but summer offers sunlight. These inclinations are often correct. Furthermore, seasonality is little more than that.

Due to its periodic cycle, gold prices typically rise in the first quarter of the year. It also rises in the latter months of the year. September would be one of the best trading months if you were intending to purchase gold.

But we have to keep in mind that they are just general suggestions. You can determine when gold is most likely to bottom, peak, rally, or decrease by looking at its seasonal cycles.

The Gold seasonal cycle is one of the instruments that demonstrates what smart money is doing, making it quite important.

Before we go into the principles of the Gold approach, let’s have a look at the indicators required to properly trade this strategy.

All you truly need are these signs.

Fibonacci Retracements are a popular kind of technical indicator. They are based on the fundamental numbers of mathematics established a few years earlier by Leonardo Fibonacci. These mathematical calculations might help us identify critical regions of support and opposition.

Let us now look at how to utilize these insider market trading tactics to successfully trade gold coins.

Simplified Gold Trading Strategy

Finally, the time period you choose will define the most effective gold trading strategy.

Interested in trading gold that day?

Do you want to swing trade gold?

Even if all you want to do is acquire gold and keep it for a long time, follow our easy gold trading method. Time the market in whichever way you trade. Our trading approach makes it easy to detect changes in gold trends. These are basic choices for purchasing and selling. For the sake of this article, we will focus on the buying side.

The first step is to purchase gold for a higher-than-average return during trading months.

The first technique is to make sure you acquire gold during the months when prices typically rise. According to the gold seasonal trend, the best periods and months to purchase gold are January, February, August, September, November, and December.

These trading months have one thing in common: an above-average return on the gold price.

Please keep in mind that we will be trading in January to provide you with a realistic trading experience.

Because clever money consistently makes the same decisions, the seasonal price pattern for gold seems to repeat itself.

Now that we’ve seen how seasonality affects the gold price, let’s move on to the second trading rule. Please keep in mind that we will be trading in January to provide you with a realistic trading experience.

Since clever money consistently makes the same decisions, the seasonal price trend for gold seems to repeat itself.

After demonstrating the influence of seasonality on gold prices, we can now address the second trading rule.

Step 2: Wait until Gold reaches the 0.618 Fibonacci retracement of the last market movement.

It is not sufficient to focus just on understanding the seasonal cycle. We feel there should be one more aspect in your trading strategy.

The seasonal pattern, together with the Fibonacci retracement indicator, suggests that there may be an opportunity to buy gold shortly.

Although this is a great trading strategy, you must be adaptable to the regulations and attempt to integrate it with the general market flow.

In our suggested gold trade example, gold has gone below the 0.618 Fibonacci retracement of the last market move. Even if this was occurring in December, it is apparent that the gold price began to rise in January 2018.

In the next phase, we’ll talk about our gold purchasing approach.

Step 3: Make a purchase at the bottom or after we cross the barrier.

Remember that while employing this kind of trading technique, flexibility is required. We are putting up a very simple plan for our gold purchasing method. If gold is trading at a support level when you do your research, you may purchase it. However, if the market begins to rebound before January, wait to purchase gold until we break above the prior level.

As you can see, the true price of gold followed a seasonal pattern. This confirmed that our seasonal analysis was correct.

Placing our protective stop loss is the second critical step we must make for our gold strategy.

Look underneath you.

Step 4: Place a stop loss order underneath the most recent bottom of the swing.

If gold continues to follow its seasonal tendency, we should expect new highs rather than new lows. We would want to terminate this position since our transaction would be invalid if gold fell to a new low. This enables us to place our protective stop loss below the previous swing bottom when trading gold using this strategy.

Step 5: Monitor your stop loss below each swing low, and you should be profitable by the end of February.

If gold has followed its seasonal pattern for the first six months, it is reasonable to expect that it will continue to do so in the future. March is one of the worst months to trade gold, according to the seasonal tendency, so liquidate your position and enjoy your profits.

If you had followed this easy gold trading method, you might have made a lot of money by correctly anticipating the current gold trend. You earned a significant profit during the previous two months as the price of gold increased from $1265 to $1366.You may also spot sell signals by using the exact opposite trading techniques. The following example demonstrates how a SELL transaction occurs:

Note*: We only sold gold in the months when there was a significant market for it.

Concluding Remarks on Gold Trading

To increase your gold trading skills and make profits similar to mine, just follow our simple, step-by-step instructions for our gold trading approach. Gold has traditionally been seen as a store of wealth or as an asset that can be held for generations without going bad.

The goal is to try to profit from trends, and you can use our insider knowledge of gold trade to determine when gold is most likely to climb or fall. Adding some gold to your portfolio to diversify it may be a highly rewarding way to invest in gold. You can also read; Gold: What Factors Drives Its Price in Trading

Thank you for taking the time to read. Follow for the latest news and informationTelegram Channel