Supply and Demand

Markets are ruled by the primitive forces of capitalism, much like the laws of gravity. In every financial market, buyers and sellers compete to find a happy medium agreement.

Traders are frequently looking for reasons to explain price movements as prices dance around on charts. The underlying cause of price movement, on the other hand, is the supply and demand relationship.

Positive news generally indicates increased demand and decreased supply, resulting in higher prices. Negative news usually means less demand and more supply.

The following fundamental aspects of supply and demand will be covered in this article:

- What are the supply and demand laws?

- Zones of supply and demand

- The Forex market’s supply and demand

- What is the relationship between supply and demand?

WHAT IS THE DIFFERENCE BETWEEN SUPPLY AND DEMAND?

The relationship between buyers and sellers that is used to determine the price in financial markets is known as supply and demand.

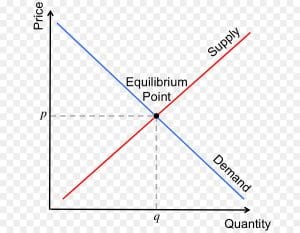

Supply and demand forces interact to affect an equilibrium price between buyers and sellers in which the quantity of demand equals the quantity of supply.

WHAT ARE THE SUPPLY AND DEMAND LAWS?

‘Supply’ refers to the amount that is simply available, whereas ‘demand’ refers to the amount that is desired. The graphs below depict the visual aspects of supply, demand, and equilibrium, in that order.

The relationship between price and quantity is referred to as supply.

supply curve

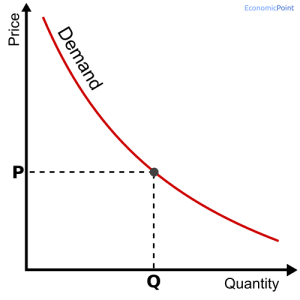

Demand is the relationship between price and quantity.

demand curve

Equilibrium pricing is defined as the price at which the quantity demanded equals the quantity supplied:

equilibrium curve

SUPPLY AND DEMAND ZONES

Supply and demand zones provide traders with insight into the current financial markets, and they are depicted in the charts below.

supply and demand zone

It is clear that supply and demand zones cover a larger area than support and resistance levels.

These broader price zones provide more consistent price regions than a single line/level and can be a better predictor of future price movements.

The supply zone below depicts a seller-dominated area because prices tend to ‘bounce’ lower outside of this demarcated zone.

The characteristics of supply and demand zones are characterized by the rapid price movement out of these zones.

The demand zone has the same characteristics as the supply zone in the opposite direction – the demand zone resembles a broad area of support.

THE FOREX MARKET’S SUPPLY AND DEMAND

Supply and demand in a simple vegetable market are not dissimilar to what happens every day in the forex market.

In some cases, these forces are moving so fast that new traders may struggle to understand the granularity of the details.

Because of the high demand for traded assets, the forex market is the world’s largest financial market.

Currencies are the foundation of the global economy, and whenever one economy wants to trade with another (assuming different currencies are used), an exchange is required.

WHERE DO SUPPLY AND DEMAND COME IN?

In a nutshell, supply and demand in the forex market work by analyzing the number of buyers and sellers.

What effect do supply and demand have on market price?

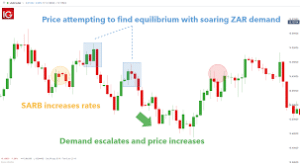

Assume the South African Reserve Bank (SARB) changes interest rates. Because of the forces of supply and demand, an entire chain reaction will be set in motion. When interest rates rise, so do forex rollover payments.

This means that investors who keep the trade open at the specified rollover time (which varies by country) will receive a higher rate of interest than they would have previously – the incentive has just increased.

All else being equal, more traders would want to buy, and fewer traders would want to sell because the opportunity cost of selling (the rollover payment) has just risen.

Forex supply and demand – USD/ZAR daily chart :

You can trade USD/ZAR on Libertex

As you can see, the price seeks to find a comfortable point and will rise until no more buyers are willing to pay that price. At this point, sellers outnumber buyers, and prices will decline as a result.

After the price has fallen far enough (red circle), traders will enter the picture, remembering the higher interest rate and the additional rollover payment that can be received by holding a long ZAR position, and this lower price represents a ‘perceived value.’

As more buyers enter the picture, the price will rise to reflect the increased demand.

This is the process of price attempting to find its fair value over a variety of time frames in every market around the world.

SUPPLY AND DEMAND IN THE CONTEXT OF SUPPORT AND RESISTANCE

The relationship between supply and demand, as well as support and resistance, is critical. This is due to the fact that when price crosses key support and resistance levels, changes in supply and demand within that currency pair may occur.

Join Doughvest Telegram channel for market updates.