Introduction: Day Trading Penny Stock

Penny stocks tend to react wildly when trade volume is high.

When trading penny stocks, keep in mind that they may be easily manipulated. With our penny stock strategy, you will be able to anticipate and profit on price manipulation.

Day trading penny stocks may be very profitable if you use penny stock trading strategies designed to detect these manipulations in micro stock values.

Before we get started with our penny stock strategy, let us first provide you with a basic explanation of penny stocks. While we cannot promise that you will become a multimillionaire penny stock trader, penny stock trading may nonetheless provide you with a good lifestyle.

How do penny stocks work?

One term used to describe a cheap stock is “penny stock.” Penny stocks are those that trade for less than $5 per share. The bulk of these stocks trade for pennies since they are common shares in small enterprises.

Most penny stocks trade over the counter, similar to currency pairs in forex, although others are listed on major stock exchanges such as the New York Stock Exchange (NYSE) or the Nasdaq.

What more is there to learn about penny stock day trading?

Because of their low volume, certain penny stocks may be very difficult to buy and sell. Other penny stocks have severe price changes and are very volatile.

Pump and dump schemes, as well as stock promoters that utilize shills to influence penny stock prices, are also to be avoided. The bottom line is that to survive in these shark-infested waters, you must trade penny stocks with extreme care and use the best penny stock approach.

Tired of losing trades? Open a Libertex account to start trading stocks and forex with the professionals today.

The Penny Stock Strategy

Pump and dump trading methods are particularly brutal. When trading these penny stocks, you must act swiftly to prevent being caught off guard. It would be like playing with fire to change the pump and dump setup. If you want to study penny stocks safely, the best way to do it is to play the pump.

We will provide you some penny stock guidance as well as a real-world example of a conventional pump-and-dump technique.

We normally recommend taking a piece of paper and a pen and making notes on the requirements for this entry method before proceeding.

In this piece, we’ll look at the buy, pump, and dump penny stock technique.

Step 1: Look for the trendiest penny stocks, with a net price movement of 5% to 10%.

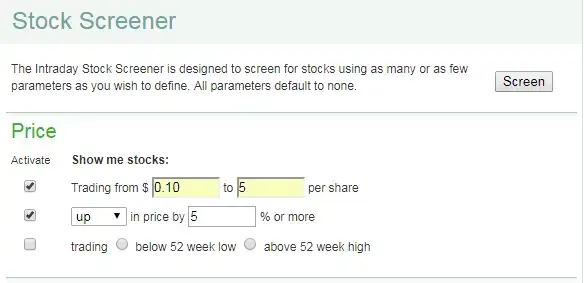

Using an internet stock screener is one method for finding popular penny stocks. We are using MarketWatch Stock Screener, the best penny stock trading website that provides free stock screening. Our penny stock approach requires a net price change of at least 5% but no more than 10%.

The pump-and-dump approach is likely to enter its markup phase if the penny stock price moves by at least 5%. However, the 10% limit on penny stock price fluctuations will prevent a runaway market.

*Note: We are only interested in penny stocks valued between $0.10 and $5.

The penny stock screener will most likely produce a large stock list like the one below:

We want to trade just the greatest penny stocks, thus we want to avoid many of these firms due to their low trading volumes.

The next step is to reduce the number of penny stocks.

Take a look below:

Step 2: Browse Active Penny Stocks with High Volume During the Day’s Trading.

To filter out, choose penny stocks with more 250k shares.

The next simple way to filter down our list is to exclude penny stocks with low volume and focus on high-volume penny stocks.

With the second filter, we were able to narrow our list of penny stocks from 85 to 28.

Let’s examine the Nasdaq penny stock listings below.

To conclude, the top penny stocks were identified using three filters:

- penny stocks with a price range of $0.10-$5.0

- Penny stocks’ net price changes vary between 5% and 10%.

- Penny stocks having at least 250 thousand shares traded.

You may also hunt for penny stocks with extremely tight spreads.

It’s time to choose one penny stock that meets all of our criteria and see whether it fits our penny stock day trading technical pattern. In addition, we will plot all of the technical indicators required to trade the pump and dump scenario on the chart.

Step 3: Connect to the diagram. Use the On Balance Volume Indicator in combination with the Bollinger Bands Indicator.

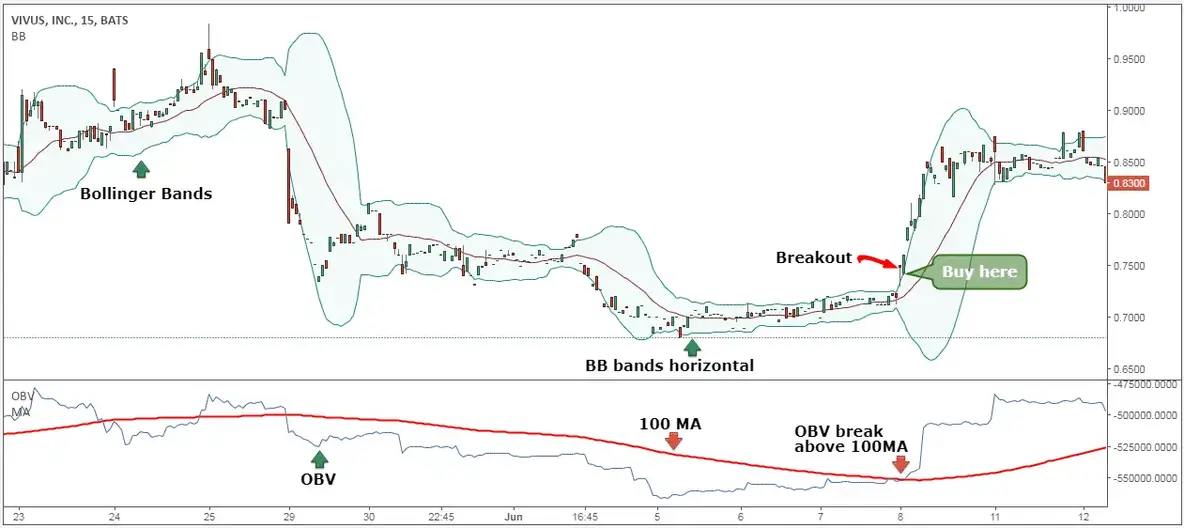

When looking for abrupt market movements, the Bollinger Bands indicator is a valuable tool. Instead of net volume, we will use On Balance Volume, or OBV, which combines price and volume to represent the total amount of money entering and exiting the market.

To further sort out the authenticity of the markup phase, we use a 100 moving average to the OBV indicator.

For these situations, we recommend VIVUS Inc.

We can now apply all of the technical indicators and filters necessary for penny stock day trading.

Let us now analyze the VIVUS chart and compare it to our pump and dump system.

Step 4: The price has to close above the top range and break through. In addition, the BB bands must travel horizontally.

The initial step of the pump and dump trading method, known as the markup phase, may be difficult to observe. Our primary goal is to ensure that we have enough profit margins to take advantage of these price manipulations.

The larger the pump and dump system, the more horizontal movement occurs in the top BB band and the bands before the above breakout.

Next, we’ll go over the signs for acquiring pump and dump penny stocks.

Examine the following:

Step 5: Buy Penny Stock: Invest When the OBV surpasses 100-MA

Moving forward, as soon as the OBV crosses above the 100-MA, we buy penny stocks. Second, ignore the setup if this trading condition is not realized during the first four candles of the penny stock’s breakthrough over the upper BB.

We believe this is a false breakthrough until the volume validates it.

When it comes to halting losses, we adopt a rather straightforward technique.

Examine the following:

Step 6: Place a protective stop loss underneath the bottom band band.

We put our stop loss below the lower Bollinger Band in line with our penny stock trading strategy. If adequate trading volume supports this breakthrough, penny stocks’ prices should not fall below the lower BB.

When dealing with penny stocks, it is critical to conduct proper risk management and avoid being too connected to any one investment.

We will next go over a simple pricing objective method.

Step #7: When the penny stock price breaks and closes below the middle BB, take profits.

When penny stocks are dumped, it generally leaves one individual carrying the bag. We’ve picked an exit strategy to assist us get out of the dump-and-dump fraud before it collapses, since we don’t want to be left holding the bag.

When the penny stock price breaks and closes below the middle BB, we recommend that you take winnings.

Final Thoughts on Day Trading Penny Stocks

When day trading penny stocks, remember to approach with extreme caution. To get expertise and a better understanding of micro stock behavior, you should always start trading penny stocks on paper. Furthermore, since free penny stock options are the most common source of financial loss for traders, you should avoid them.

Using our penny stock trading guide to select out high-quality businesses before timing the market using technical analysis is the only way to effectively day trade penny stocks. Check out our recommendations for the Best Price Action Strategy: Day Trading price Action

Thank you for taking the time to read.Telegram Channel