Three unusual price action patterns that you may not be aware of may provide possibilities for traders seeking a competitive advantage in the tumultuous markets of 2025 that most market players miss.

When traditional technical analysis fails, recognising unusual but dependable candlestick patterns that signify high-probability setups is an important component of a solid price action trading approach. Skilled traders can gain an advantage by using these lesser-known indicators, which often predict significant market moves.

Understanding these sensitive price movement indications does not need paying attention to financial media noise or following popular signals. It requires being skilled at spotting distinct price action patterns with unusual pricing structures that predict future market movements. Learning the language of concealed price movement patterns is a technical and artistic endeavour that requires time to perfect.

These three price action patterns, which you may not be familiar with, are influencing how we trade:

- The Shadow Pivot is a sophisticated reversal pattern in which the price seems to be following the trend but is really forming a concealed accumulation zone.

- The phantom breakout is a misleading pattern that traps momentum traders before unexpectedly turning around.

- The “Hidden Harbinger” is a unique continuation pattern that predicts institutional positioning prior to a significant trend acceleration.

To achieve extraordinary returns, traders must reevaluate how they approach chart analysis and risk management in light of these enigmatic trading habits. The precise entry conditions, stop placement procedures, and profit goals for each stock trading pattern will be discussed in depth.

These complicated trading tactics are becoming more important tools for experienced traders looking to remain ahead of the curve in 2025 and beyond, as markets transform and conventional market behaviour research loses credibility.

Let’s look at how you may utilise these three unusual price action patterns to change your trading strategy.

Being aware of price action

Price action has a distinct appeal for contemporary stock market investors seeking a trading edge. The purest form of trend analysis in trading, price action focusses on pure price movements without the distraction of complicated technical overlays that often obscure the fundamental market dynamics.You can also read: Best Price Action Strategy: Day Trading Price Action

Understanding How Prices Have Changed in Recent Years

Because of the huge changes in the trading environment in 2025, new approaches for detecting candlestick patterns and interpreting market data are needed. Today’s algorithmic-driven markets leave distinct fingerprints that reveal previously unknown pricing patterns reflecting institutional positioning, which clever traders may exploit.

- Innovation: To succeed in today’s markets, one must detect new price movement patterns that go beyond classic technical analysis.\

- Adaptation: By immediately identifying emergent forms, traders may remain ahead of algorithms.

- Validation: To demonstrate that these PA patterns are dependable, comprehensive historical testing and current findings are required.

How to Identify Patterns in Data

Markets are continually moving, resulting in new trends as institutional trading methods adapt and evolve. This is an important realisation in contemporary commerce. Modern traders must be vigilant and open-minded, ready to see developing chart patterns that may indicate major swings before other traders do.

Understanding how old trends change and give rise to new versions that reflect current market conditions is critical.

The Shadow Pivot, Phantom Breakout, and Hidden Harbinger patterns were created after a thorough research of how old formations have developed to meet contemporary market circumstances. These tendencies often occur when traditional technical analysis points to one conclusion and institutional order flow points to another.

This divergence creates possibilities for traders who comprehend these subtle but strong structures.Tired of losing trades? Open a Libertex account to start trading stocks and forex with the professionals today.

Three Unusual Patterns of Price Action

Here are the top three price action patterns that you may not be aware of:

1) Phantom Breakout

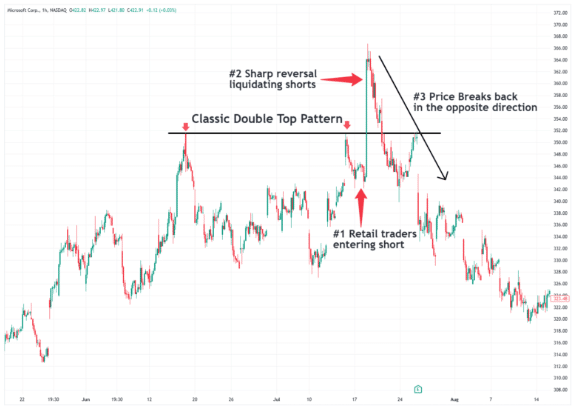

Phantom breakouts occur when a price makes a strong breakout increase from a recognisable pattern before quickly reversing within a certain range, usually 15% or less. Initially, the “breakout” seems to be genuine, attracting momentum traders until the abrupt and stunning reversal catches them on the other end.

The Phantom Breakout’s success stems from its ability to leverage the collective thinking of stranded traders looking to exit positions.

Why is this pattern effective?

The solution resides in institutional trading techniques and market structure. Large institutional investors sometimes expand their holdings by creating breakouts that cause retail stops before the price moves in the desired direction.

The Phantom Breakout, like any other complicated pattern, demands thorough verification and prudent risk management in order to be lucrative.

Price-Action Trading Approach

Three price action patterns you’ve never heard of and one Phantom Breakout. Critical Components

According to a detailed research of market behaviour, a real phantom breakout involves the following elements:

- The price breaks out strongly from a well-known chart pattern, clearing important resistance or support levels, as confirmed by increasing volume and momentum indicators.

- The breakout only surpasses the pattern border by 15% before exhibiting symptoms of weakness.

- The turnaround is abrupt.

- It is clear that the price goes back in the opposite direction of the typical price action pattern.

Shadow Pivot

Though it may seem easy at first look, the red circle on the chart indicates the key construction that defines the Shadow Pivot pattern. The candlestick pattern is unmistakable, with an extremely broad range and equal-length upper and lower shadows, despite the fact that the actual body of this extraordinary masterpiece remains very huge.

The Shadow Pivot often arises during powerful trending movements and has important implications for trend continuance. The actual trend continuation signal is generated when the price breaks strongly above the top wick of this important candlestick.

The pattern implies institutional positioning, as smart money discreetly builds stakes. During the first phase, the price moves dramatically, potentially trapping many trend reversal traders and feeding the trend into the next trading day.

Hidden Harbingerz

The red circle on the daily chart represents the Hidden Harbinger pattern, a three-candle price structure. The price goes sideways in a tight consolidation before creating the first big reversal bar, which often has a large range. Next, a countertrend bar closes inside the previous day’s trading range but reverses it. The last component is a strong thrust bar that connects to the extremity of the first reversal bar.

The Hidden Harbinger is an effective continuation pattern since it often appears during strong trends and indicates an impending acceleration in the prevailing direction. The breakout happens when the price consistently breaks through the pattern’s edge with rising volume.

You may not be familiar with these three types of price behaviour.

As we approach the 2025 trading environment, knowing these three price action patterns—the Shadow Pivot, Phantom Breakout, and Hidden Harbinger—may provide you with the competitive advantage you need, even while conventional technical analysis remains useful.

Thank you for taking the time to read. Follow for the latest news and information.Telegram Channel